A wise man once said that the friction between opinions is where education is found; I would offer that’s also where profits reside. It’s a tale as old as Wall Street itself.

Shit, wrong image; I saw Yellen on TV and got confused. Here:

I posted those whispering angels last week, eyeing the catalysts and peeking around the corner at an emerging head & shoulders formation where a break of $MSOS $40 would “target” $25 (through a pure technical lens; a discussion on how four primary metrics shape this investment can be found here).

That was after we discussed how, on the one-year anniversary of the cannabis bull market, the easy trade was behind us and multiples have re-rated the fundamental shock absorbers away, at least when measuring 2022 against the current footprint.

We even shared the unthinkable: the what-if every cannabis investor fears most even if they’re wearing a brave twitter face. The FUBAR outcome; the ultimate insult. The are you flapping kidding me scenario that would punish the most people.

Decent foresight, right? Good instincts? I mean, US canna lost 10% since that post?

Not really; sure, I saw the other side, as experience has taught me to do, but we didn’t lighten up as much as we traded around core positions and rotated risk, a fact I’ll share because simply because it’s true.

No shame in admitting it’s hard, only in pretending it’s not.

Fast Forward to this week

That sorta remains in play, right? I almost titled this column Retail Therapy because a quick stroll through twitter last night suggested most retail traders would benefit from 45 minutes, a comfortable couch and a thoughtful ear.

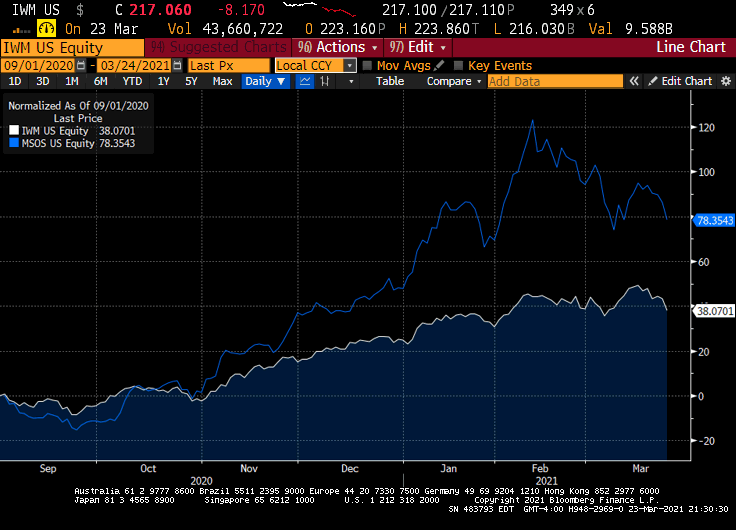

And who can blame ‘em? We can pick the direction or the timing but it’s real hard to nail both. US Cannabis ETF $MSOS rallied 120% from September 1st to February 10th, before pulling back 26% at last week’s low (21% vs. last night’s close). At any given time, investors could have moved to the sideline.

We didn’t; in fact, we were fired up entering this week with the Murderer’s Row on tap. Remember, we need to see three things for this rally to continue: fudamental growth, continued state adoption and federal follow-through. To wit,

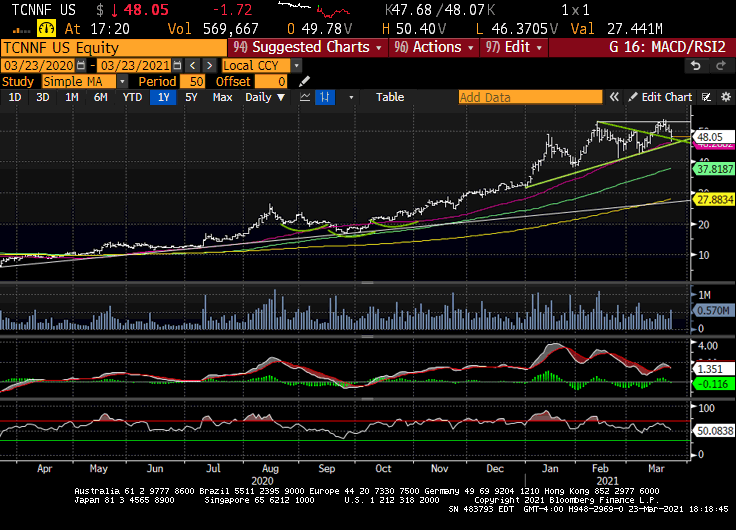

Trulieve ($TCNNF) put up a big beat / solid guidance (despite best efforts to sandbag) and as analysts trip over themselves to raise price targets, the reigning SEC champ is testing the 2021 uptrend / is 10% from fresh all-time highs.

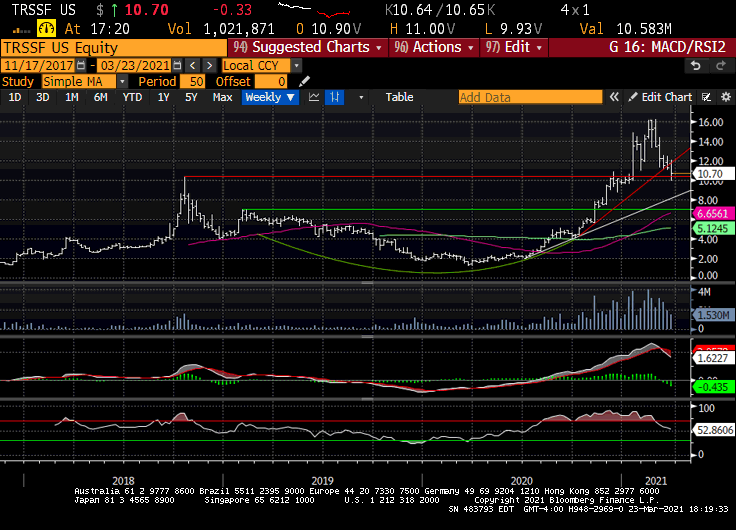

TerrAscend ($TRSSF) the 2020 performance champ (+359%), raised guidance above the high-end of street estimates as JW announced plans to upgrade the corner office. The stock everyone was terra-envious about last year has retraced 40% of it’s entire market cap in the last month—right to the 2018/ 2021 breakout.

[Cresco reports Thursday morning, Harvest next week, and others…)

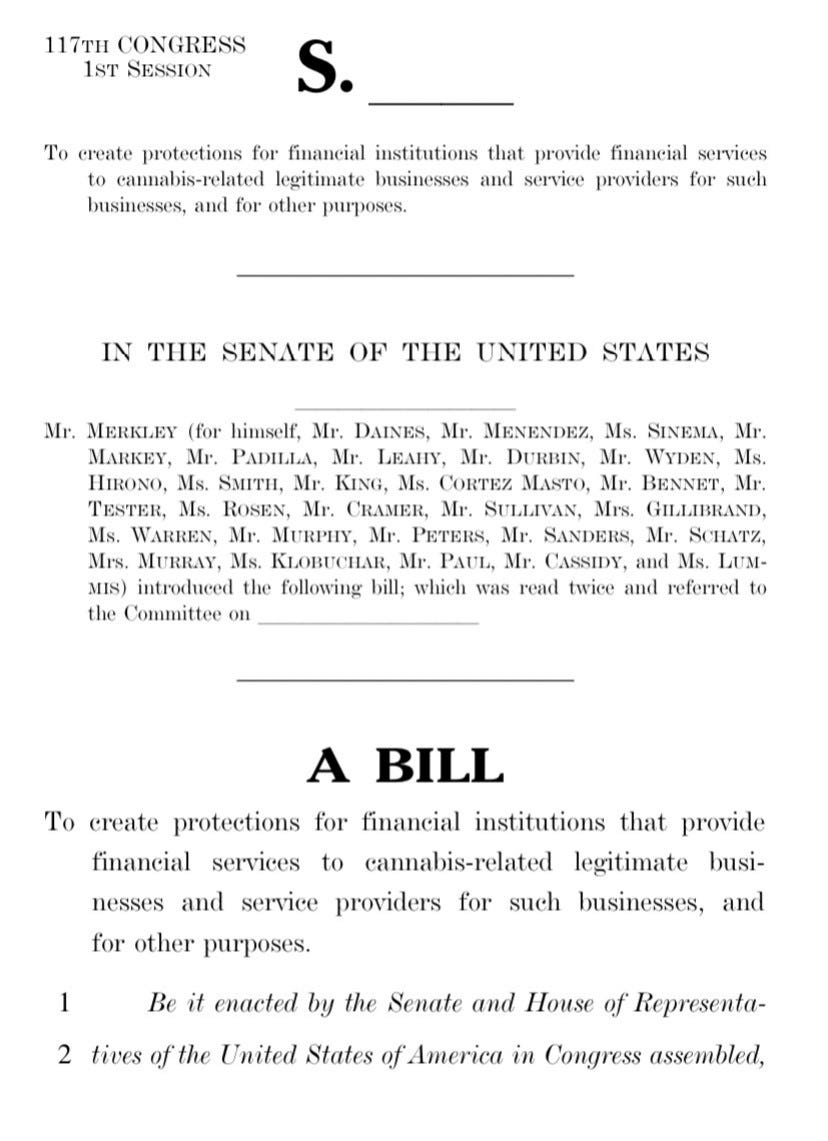

We got the Senate response to SAFE Banking yesterday, sponsored by Sens. Jeff Merkley (D-OR) and Steve Daines (R-MT) w nearly a third of the chamber signed.

While peeps were upset capital markets language wasn’t in this version of the bill, that was very much by design. As Brady and Jeff noted, the chosen path on the beltway is one of incrementalism bc “if you hang too many ornaments on the tree, it’ll fall over.”

That’s why the plan has been to pass SAFE (as-is) which, along with FinCEN guidance and an updated Cole Memo, should be enough shift the cannabis convo from a matter of law to one of compliance for listers and lenders alike.

We even had New York all but hit the tape, as the Big Apple is evidently “really, really, really close” to flipping the switch and ensuring the fall of the eastern bloc.

Strong (to quite strong) earnings.

SAFE Banking in both chambers, and quickly.

New York— NEW F*CKING YORK— could advance / maybe even sign this week.

And US cannabis was down 4% yesterday.

What gives? Maybe the mishigas at the White House.

Because, you know…

There’s a conventional explanation: that good news was already baked into the 215% (down from 348%) year-over-year rally in the North American MJ Index; particularly with the easy trade in the rear-view and fast money ringing the register.

And sure, we don’t know if SAFE will have the votes in the Senate. We don’t know if Schumer’s Grand Plan sees the light of day. There are variant viruses; the market, even the price action in small-caps, which trade in muted tandem w US canna…

But still… it smells like something else. Almost like… Wall Street F*ckery.

Anyone who’s traded canna for years is likely still suffering from PTSD, or Pershing Traumatic Stress Disorder. For newbies, that occured when the largest clearing agent for cannabis-related securities told holders to piss off last December; they would only allow sell orders, not buy orders, given the federal framework.

That triggered the swan-dive song for global cannabis, the meltdown that drove us into the cyclical low of the secular bull one year ago this week. But given the blue wave and green needs, that’s surely behind us, especially after the perfect storm,

Right?

Last month, we heard two Swiss banks implemented similar policies restricting cannabis-related securities, but were told it was more about having an actual policy in the first, which was evidently necessary before further changes could be made.

But yesterday, we picked up something new: that a top-five US bank was telling clients “any cannabis company that doesn't trade on TSX or Venture is unapproved for even agency trading by the firm.”

In other words, no CSE stocks, which is where U.S multistate operators are forced to list given the pay-no-mind signs hanging NYSE and NASDAQ.

Now, this firm has been standoffish on the space for some time but evidently, someone high-on-up decided that now would be an appropriate time to restrict their clients’ ability to purchase US cannabis stocks. It’s almost as if they want prices lower.

I can’t prove there’s some sorta secret society trying to ratchet down price levels and even if I could, who cares? There’s no crying in baseball and there’s no whining when trading so we’ll take what we get and we won’t get upset.

Just understand there are things we can control and things we cannot, much of which is happening below the surface of what we see on our screens. Sync your time horizon and risk profile, find a style that works for you, do the work, and hold on tight.

2021 is about to get interesting.

/positions in stocks mentioned / advisor $MSOS